Add funds to your ISA portfolio

You can add funds to your ISA portfolio by clicking the link at the top of your portfolio dashboard.

Simply follow the instructions on screen, choosing either debit card or bank transfer.

The minimum you can deposit into your ISA portfolio is £250 and following bank transfers, we aim for funds to appear in your account 3 business days after your transfer is made.

If you fund your account in a currency other than GBP, your bank will convert the amounts at their specified exchange rate.

Transfer in another ISA

Transferring another ISA into your LHX ISA is easy. Simply fill out the transfer form and we will take care of the rest. There is no need to contact the ISA provider you are transferring from. Click here for more information on transferring an ISA.

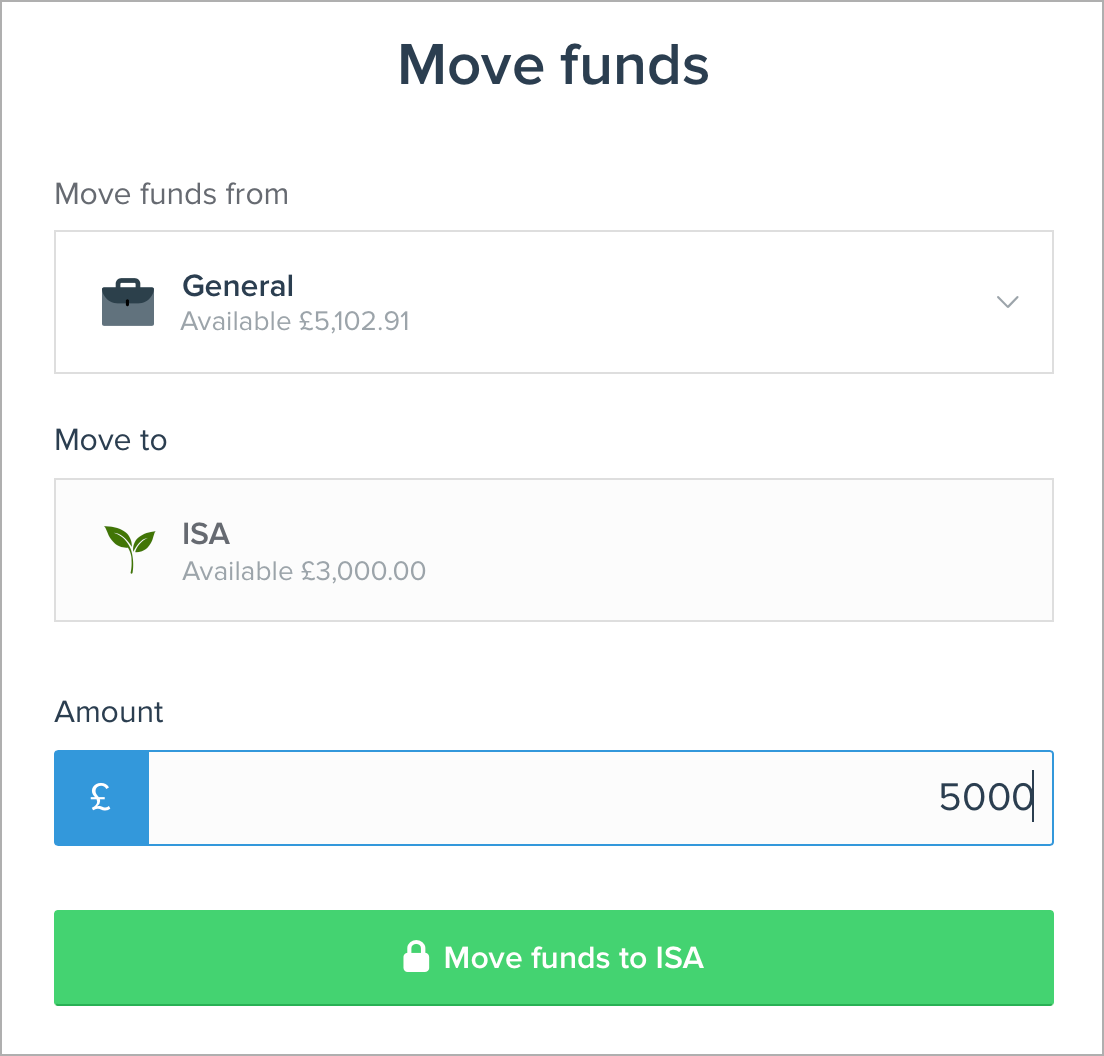

Moving funds between your General portfolio and ISA portfolio

If you have opened an ISA portfolio, your LHX account has two portfolios: General and ISA. You can move funds (cash) between each portfolio by clicking on the ‘Move funds’ link at the top of either portfolio’s dashboard.

Simply choose which direction you wish to move funds and how much you would like to move. There is no minimum and funds are moved instantly.

Withdrawing funds

To withdraw funds from your ISA portfolio click on the link at the top of the dashboard and follow the instructions on screen. Please click here for more information on withdrawing funds.

You can withdraw uninvested funds (available funds) at any time from your ISA portfolio. You can also move uninvested funds to your general portfolio so you can use these funds to invest in properties. There are no charges for withdrawing or moving funds.

Is this ISA flexible?

Yes, the LHX ISA is flexible. This means if you withdraw funds from your ISA portfolio you can replace it during the same tax year without using up any more of your annual allowance.To read our ISA terms and conditions, click here.

To read our ISA terms and conditions, click here.

Comments

0 comments

Article is closed for comments.